My opinion: Sell the pair from correction below the level of 1.1050 with a target at 1.04 – 1.03.

Alternative scenario: Breakdown of the level 1.1050 and consolidation above will allow the pair to continue the rise up to levels 1.13 – 1.14.

Analysis: The fifth final wave continues to develop within bearish trend. Apparently, a local correction in a form of fourth wave of junior level (iv) has just finished and the final fifth wave (v) has started to form. The level 1.1050 is critical in this scenario. If the presumption is correct, the pair will logically continue to drop to a level of 1.03.

GBP/USD Wave analysis and forecast of 27.03 – 03.04: The pair is under correction, but growth might be resumed.Estimated pivot point is at a level of 1.4628.

My opinion: Wait for completion of correction and buy the pair above the level of 1.4628 with a target at about 1.5220 – 1.54.

Alternative scenario: Consolidation below the level of 1.4628 will allow the pair to continue declining to the levels of 1.45 – 1.44 within a downtrend.

Analysis: Presumably, the fifth final wave within long-term bearish impetus has already formed. The counter-trend impetus (i) has formed by now and a local correction in a form of wave (ii) is nearing completion. The level of 1.4628 is critical in this scenario. If this assumption is correct, the pair will resume growth.

AUD/USD Wave analysis and forecast of 27.03 – 03.04: The pair is expected to rise due to correction.Estimated pivot point is at a level of 0.77.My opinion: Buy the pair from corrections above the level of 0.77 with a target at 0.7986. In case of breakdown and consolidation below the level of 0.77, the selling target can be set at 0.7580 – 0.7480.

Alternative scenario: Breakdown and consolidation below the level of 0.77 will allow the pair to continue declining to the levels 0.7580 – 0.7480.

Analysis: Apparently, a bullish correction in a form of fourth wave (4) continues to form. A wedge is forming now, apparently, with the fourth wave of junior level (iv) nearing completion within. If the presumption is correct, after correction, the pair will continue to grow to a level of 0.7986. The level 0.77 is critical in this scenario.

USD/JPY Wave analysis and forecast of 27.03 – 03.04: The pair is expected to fall due to correction.Estimated pivot point is at a level of 121.96.

My opinion: Sell the pair from correction below the level of 121.96 with a target at 116.80. Buy the pair with a target at 124.00 in case the level 121.96 is broken.

Alternative scenario: Breakdown and consolidation below the level of 121.96 will allow the pair to continue rising to a level of 124.00.

Analysis: Apparently, a bullish impetus in the third wave 3 has finished on the daily time-frame by now. The fourth wave 4 is forming locally. If this assumption is correct and the price does not break the critical level 121.96, the pair will continue to decline to a level of 116.80.

USD/СAD Wave analysis and forecast of for 27.03 – 03.04: The pair is expected to grow.Estimated pivot point is at a level of 1.24.

My opinion: Buy above the level of 1.24 with a target at 1.30.

Alternative scenario: Breakout and consolidation below the level of 1.24 will allow the pair to continue declining to the levels of 1.22 - 1.20.

Analysis: Supposedly, a local bearish correction in a form of wave iv has finished developing. Apparently, the fifth wave starts to form locally. If the assumption is correct, the pair will logically rise to a level of 1.30. The level of 1.24 is critical in this scenario as its breakdown will result in a further decline of the pair.

!['EUR-USD DAILY REPORT 11/03/2015

[Approaching a bottom] Key Level: 1.1217

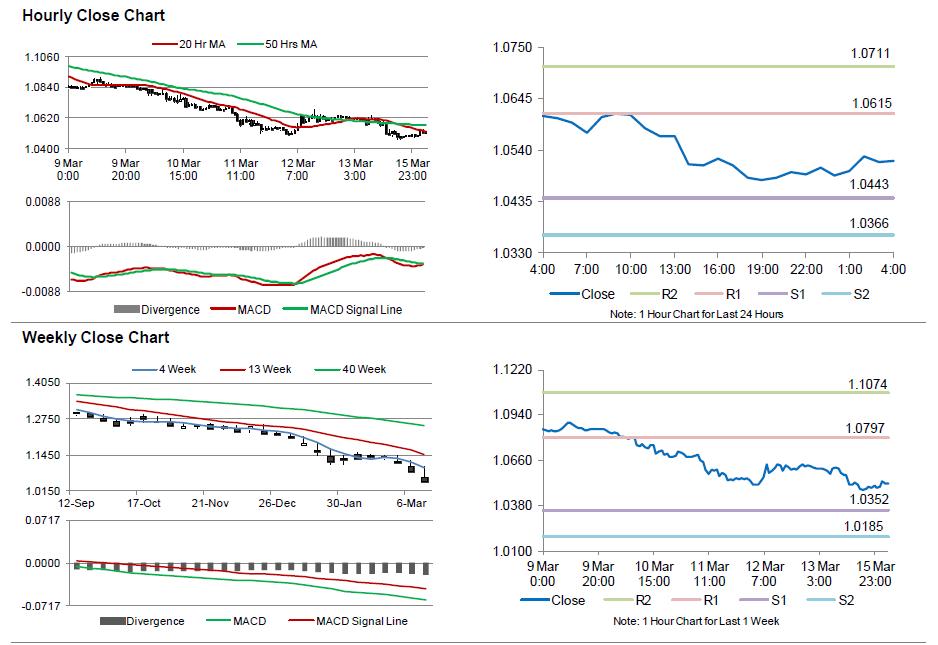

EURUSD continued lower Tuesday and closing on its lows remains vulnerable. That said, keep in mind that the current decline likely represents a terminal thrust from a triangle, a finishing fifth wave. It should bring the larger decline to an end. A rally in five waves at small degree would offer the first hint a bottom has been established.

The increased chatter in the financial press about the strength of the dollar and the resulting expectation that EURUSD will trade at parity is another reason to believe the decline from May 2014 is mature. The Daily Sentiment Index (courtesy of trade-futures.com) is once again in single digits. Are there any sellers left?'](https://fbcdn-sphotos-e-a.akamaihd.net/hphotos-ak-xpf1/v/t1.0-9/11068404_599842956818831_2219339635759132780_n.jpg?oh=a758797df621052e994cd44c510213ac&oe=558FC5D1&__gda__=1434858683_0eec519471149906b05cec5cba08f3be)