EUR/USD Wave analysis and forecast of 24.07 – 31.07: The pair is likely to rise.

Estimated pivot point is at a level of 1.0864.

Our opinion: Buy the pair from correction above the level of 1.0864 with the target of 1.1220 – 1.1435.

Alternative scenario: Breakout of the level of 1.0864 and consolidation below this level will enable the price to continue decline to the level of 1.07.

Analysis: Presumably, the formation of the “bearish” correction of the senior level has completed in the wave 2, which currently has a shape of a zigzag. Locally, it seems that a small one-two impetus has been developed. If this assumption proves to be correct, after the completion of the correction the pair will continue to rise to the levels of 1.12 – 1.14. Critical level for this scenario is 1.0864. Breakdown of this level will enable the pair to continue decline to the level of 1.07.

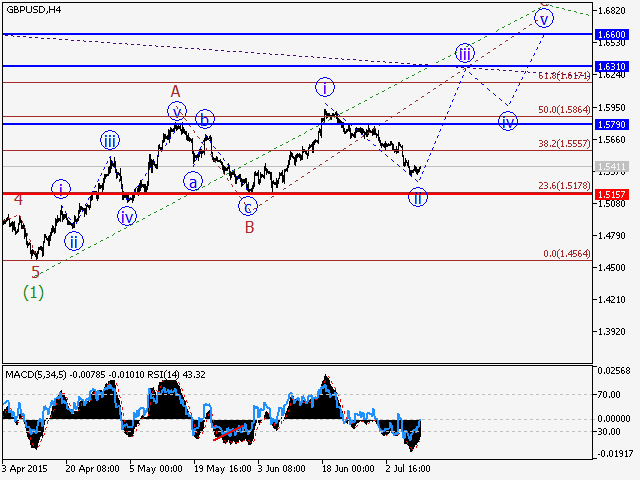

GBP/USD Wave analysis and forecast of 24.07 – 31.07: The pair is likely to grow.

GBP/USD Wave analysis and forecast of 24.07 – 31.07: The pair is likely to grow.

Estimated pivot point is at a level of 1.5328.

Our opinion: Buy the pair above the level of 1.5328 with the target of 1.58 – 1.63.

Alternative scenario: Breakout and consolidation of the price below the level of 1.5328 will enable the price to continue decline to the level of 1.50.

Analysis: Presumably, the wave С of 2 continues to develop as part of the upward “bullish” correction of the senior level. At the moment, it seems that the wave iii of C is being formed, within which the one-two wedge as the wave (i) of iii has developed, and the wave (ii) is nearing completion. If this assumption is correct and the price does not break down the critical level of 1.5328, the pair will continue to grow to the level of 1.63 in the third wave.

USD/CHF Wave analysis and forecast for 24.07 – 31.07: Uptrend continues.

USD/CHF Wave analysis and forecast for 24.07 – 31.07: Uptrend continues.

Estimated pivot point is at a level of 0.9519.

Our opinion: Buy the pair from the correction above the level of 0.9519 with the target of 0.9840. In case of breakdown of the level of 0.9519, sell the pair with the target of 0.93.

Alternative scenario: Breakout and consolidation of the price below the level of 0.9519 will trigger the decline in the pair to the level of 0.93.

Analysis: Presumably, the formation of the third wave of the senior level 3 continues. Within this wave the third wave (iii) of 3 is being formed. Locally, it seems as if the correction as the fourth wave iv of (iii) has completed and the price is likely to rise up to 0.9840. Critical level for this scenario is 0.9519.

USD/JPY Wave analysis and forecast of 24.07 – 31.07: Local correction is being formed.

USD/JPY Wave analysis and forecast of 24.07 – 31.07: Local correction is being formed.

Estimated pivot point is at a level of 124.50.

Our opinion: Sell the pair below the level of 124.50 with the target of 122.80 – 122.40. In case of breakdown of the level of 124.50, buy the pair with the target of 126.50.

Alternative scenario: Breakout and consolidation of the price above the level of 124.50 will enable the price to continue to rise up to 126.50, as part of the upward trend.

Analysis: Presumably, the formation of the one-two impetus as the first wave (i) has completed in the third wave iii of 5 of the senior level. Locally, the local correction is being developed to the levels 38 - 50%, 122.85 – 122.40. Critical level for this scenario is 124.50.

USD/СAD Wave analysis and forecast of for 24.07 – 31.07: Upward trend continues; correction is possible.

USD/СAD Wave analysis and forecast of for 24.07 – 31.07: Upward trend continues; correction is possible.

Estimated pivot point is at a level of 1.2912.

Our opinion: Buy the pair from the correction above the level of 1.2912 with the target of 1.33. In case of breakdown of the level of 1.2912, sell the pair with the target of 1.2674.

Alternative scenario: Breakout and consolidation of the price below the level of 1.2912 will enable the pair to continue to decline to 1.2674.

Analysis: Presumably, the formation of the third wave iii of 5 of the senior level has completed. Locally it is likely that the “bullish” impetus in the fifth wave of the junior level (v) of iii is nearing completion. If this assumption is correct, after the breakdown of the level 1.2912, the correction as the fourth wave of the senior level will evolve. At the moment, it is possible that the pair will continue to grow and the extension in the third wave will develop.

EUR/USD Wave analysis and forecast of 17.07 – 24.07: The formation of the downward correction continues.

Estimated pivot point is at a level of 1.1210.

Our opinion: Wait for the completion of the upward correction and sell the pair below the level of 1.1210 with the target of 1.08 – 1.07.

Alternative scenario: Breakout of the level of 1.1210 and consolidation below this level, will enable the price to continue decline to 1.08 – 1.07.

Analysis: The formation of the “bearish” correction of the senior level continues in the wave 2. Locally, it is assumed that the wave С of 2 is being developed within which the impetus as the wave (a) of C has been formed and the upward correction as the wave (b) of C can be developed. If this assumption is correct, after its completion the pair will continue to decline to 1.08 – 1.07. Critical level for this scenario is 1.1210. Breakdown of this level will enable the pair to resume the rise.

GBP/USD Wave analysis and forecast of 17.07 – 24.07: The pair is likely to grow.

GBP/USD Wave analysis and forecast of 17.07 – 24.07: The pair is likely to grow.

Estimated pivot point is at a level of 1.5328.

Our opinion: Buy the pair above the level of 1.5328 with the target of 1.58 – 1.63.

Alternative scenario: Breakdown and consolidation of the price below the level of 1.5328 will enable the pair to continue decline to 1.50.

Analysis: Presumably, the wave С of 2 continues to develop as part of the “bullish” correction of the senior level. At the moment it seems that the formation of the local correction as the wave ii of C has completed. At the same time the third wave is being developed, within which the wave (i) of iii seems being formed. If this assumption is correct and the price does not break down the critical level of 1.5328, the pair can continue to rise up to 1.63 in the third wave.

USD/CHF Wave analysis and forecast for 17.07 – 24.07: The pair is likely to grow.

USD/CHF Wave analysis and forecast for 17.07 – 24.07: The pair is likely to grow.

Estimated pivot point is at a level of 0.9326.

Our opinion: Buy the pair from correction above the level of 0.9326 with the target of 0.9840. In case of breakdown of the level of 0.9326, sell with the target of 0.91.

Alternative scenario: Breakout and consolidation of the price below the level of 0.9326 will allow the decline to continue to 0.91 – 0.90.

Analysis: Presumably, the third wave of the senior level 3 continues to develop; within this wave the one-two wedge (i) of iii of 3 has been formed and the local correction (ii) of iii has completed. If this assumption is correct, the pair can continue to grow up to 0.9840. Critical level for this scenario is 0.9326.

USD/JPY Wave analysis and forecast of 17.07 – 24.07: Growth in the pair has resumed.

USD/JPY Wave analysis and forecast of 17.07 – 24.07: Growth in the pair has resumed.

Estimated pivot point is at a level of 120.35.

Our opinion: In the short-term: wait for the completion of the impetus and sell the pair with the target of 122.50 – 122.00. In the medium-term: wait for the completion of the correction and buy the pair above the level of 120.35 with the target of 126.00 – 128.00.

Alternative scenario: Breakdown and consolidation of the price below the level of 120.35 will trigger the decline in the pair to 118.00 – 117.00.

Analysis: The American dollar is strengthening against the Japanese Yen. Due to the resumed growth in the pair we can assume that the fifth wave continues to develop in the long-term “bullish” trend. At the moment it is likely that the one-two impetus as the first wave (i) is being formed in the third wave iii of 5. If this assumption is correct, after its completion we can expect the local correction to the levels of 122.50 – 122.00. In the medium-term the pair is likely to grow. Critical level for this scenario is 120.35.

USD/СAD Wave analysis and forecast of for 17.07 – 24.07: Uptrend continues.

USD/СAD Wave analysis and forecast of for 17.07 – 24.07: Uptrend continues.

Estimated pivot point is at a level of 1.2650.

Our opinion: Buy the pair from correction above the level of 1.2650 with the target of 1.3060 – 1.33.

Alternative scenario: Breakout and consolidation of the price below the level of 1.2650 enable the pair to continue decline to 1.25 – 1.24.

Analysis: Presumably, the formation of the third wave of the senior level iii of 5 is nearing completion. Locally, it is likely that the “bullish” impetus is being developed in the fifth wave of the junior level (v) of iii. If this assumption is correct, the pair can continue to grow up to 1.3060. It is possible that from this level the local correction will develop in the fourth wave of the senior level. Critical level for this scenario is 1.2650.

EUR/USD Wave analysis and forecast of 10.07 – 17.07: Formation of the downward correction.

Estimated pivot point is at a level of 1.0987.

Our opinion: In the short-term: buy the pair from correction above the level of 1.0987 with the target of 1.12. In case of breakdown of the level of 1.0987, sell the pair with the target of 1.08 – 1.07.

Alternative scenario: Breakout of the level of 1.0987 and consolidation below this level will enable the decline in the pair to 1.08 – 1.07.

Analysis: The European currency continues to decline. It seems that the correction of the senior level within the wave 2 is being formed. Locally, it is possible that the zigzag in the first wave a of 2 has completed and the wave b of 2 is being formed to the level 1.12. If this assumption is correct after the completion of the correction the pair will continue to decline to the levels of 1.08 – 1.07.

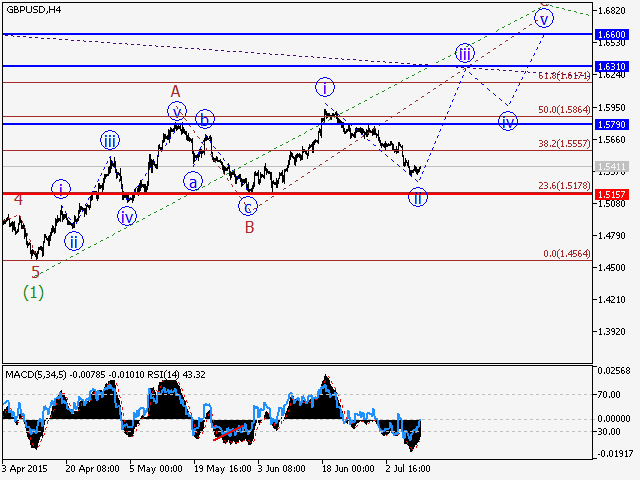

GBP/USD Wave analysis and forecast of 10.07 – 17.07: Correction has completed. The pair is likely to grow.

GBP/USD Wave analysis and forecast of 10.07 – 17.07: Correction has completed. The pair is likely to grow.

Estimated pivot point is at a level of 1.5157.

Our opinion: Buy the pair above the level of 1.5157 with the target of 1.58 – 1.63.

Alternative scenario: Breakdown and consolidation of the price below the level of 1.5157 will enable the pair to go down to 1.45.

Analysis: Presumably, the development of the wave С of 2 is still ongoing in the upward “bullish” correction of the senior level. At the moment the pair is undergoing correction within the wave ii of C, which seems is close to completion and has the shape of a zigzag (a)(b)(c). If this assumption is correct and the price does not break down the critical level of 1.5157, the pair can soon resume growth to the level of 1.63 in the third wave.

USD/CHF Wave analysis and forecast for 10.07 – 17.07: The pair is likely to decline within the correction.

USD/CHF Wave analysis and forecast for 10.07 – 17.07: The pair is likely to decline within the correction.

Estimated pivot point is at a level of 0.9146.

Our opinion: In the short-term: sell the pair from correction below the level of 0.9518 with the target of 0.93. In the medium-term: wait for the completion of the correction and buy the pair above the level of 0.9146 with the target of 0.9840.

Alternative scenario: Breakout and consolidation of the price below the level of 0.9146 will trigger further decline in the pair to 0.90 – 0.88.

Analysis: Presumably, the formation of the third wave of the senior level 3continues; within this wave the one-two wedge (i) of iii of 3 has been formed and the development of the local correct (ii) of iii is expected. If this assumption is correct, after the completion of the correction the pair will continue to rise up to 0.9840. Critical level for this scenario is 0.9146.

USD/JPY Wave analysis and forecast of 10.07 – 17.07: Downtrend continues.

USD/JPY Wave analysis and forecast of 10.07 – 17.07: Downtrend continues.

Estimated pivot point is at a level of 122.96.

Our opinion: Sell the pair from correction below the level of 122.96 with the target of 120.00 - 119.00. In case of breakdown of the level of 122.96 buy the pair with the target of 125.00 – 126.00.

Alternative scenario: Breakdown and consolidation of the price above the level of 122.96 will cause the rise in the pair up to 125.00 – 126.00.

Analysis: The formation of the third wave of the senior level continues on the four-hour timeframe. Locally, it seems that the third wave of the junior level is being formed (iii). If this assumption is correct and the price does not break down the critical level of 122.96, we can expect that the pair will continue to decline to the levels of 119.80 – 119.00.

USD/СAD Wave analysis and forecast of for 10.07 – 17.07: Uptrend continues.

USD/СAD Wave analysis and forecast of for 10.07 – 17.07: Uptrend continues.

Estimated pivot point is at a level of 1.2520.

Our opinion: Buy the pair from correction above the level of 1.2520 with the target of 1.29. If the level of 1.2520 is broken down, sell the pair with the target of 1.23 – 1.22.

Alternative scenario: Breakout and consolidation of the price below the level of 1.2520 will enable the pair to continue decline to 1.23 – 1.22.

Analysis: The formation of third wave of the senior level iii of 5 continues. Locally, it is likely that the “bullish” impetus has completed in the third wave of the junior level (iii) of iii, and the local correction as the wave (iv) of iii is being formed. If this assumption is correct, after the completion of the correction the pair will continue to rise up to 1.29. Critical level for this scenario is 1.2520. Break down of this level will allow the pair to continue decline to 1.23 – 1.22.

EUR/USD Wave analysis and forecast of 03.07 – 10.07: The pair is likely to grow.

Estimated pivot point is at a level of 1.0944.

Our opinion: Sell the pair from correction above the level of 1.0940 with the target of 1.15 – 1.17. In case of breakdown of the level of 1.0940 sell the pair with the target of 1.08 – 1.07.

Alternative scenario: Breakout of the level of 1.0944 and consolidation below this level will enable the price to continue decline to 1.08 – 1.07.

Analysis: Presumably, formation of the fifth wave continues within the upward wedge. Locally, it is likely that the “bearish” correction of the junior level as the wave (ii) of v has completed and a small one-two impetus I has been formed within the third wave (iii) of v. If this assumption is correct, the pair can soon continue to rise to the levels of 1.14 – 1.15. Critical level for this scenario is 1.0944. Breakdown of this level will enable continuation of the bearish correction up to 1.08 – 1.07.

GBP/USD Wave analysis and forecast of 03.07 – 10.07: Correction is nearing completion; the pair is likely to grow.

GBP/USD Wave analysis and forecast of 03.07 – 10.07: Correction is nearing completion; the pair is likely to grow.

Estimated pivot point is at a level of 1.5157.

Our opinion: Wait for the completion of the correction and in case of the upward one-two impetus, buy the pair with the target of 1.60 – 1.63.

Alternative scenario: Breakdown and consolidation of the price below the level of 1.5157 will enable the pair to continue decline to 1.45.

Analysis: Presumably, the development of the wave С of 2 continues in the upward “bullish” correction of the senior level. At the moment it is likely that the formation of the first wave i of C has completed and the local correction as the second wave ii of C is being formed. If this assumption is correct, after the completion of the correction the pair can continue to rise up to 1.64.

USD/CHF Wave analysis and forecast for 03.07 – 10.07: The pair is likely to grow.

USD/CHF Wave analysis and forecast for 03.07 – 10.07: The pair is likely to grow.

Estimated pivot point is at a level of 0.9238.

Our opinion: Buy the pair from correction above the level of 0.9238 with the target of 0.9840 – 1.00. In case of breakdown of the level of 0.9238, sell the pair with the target of 0.91 – 0.90.

Alternative scenario: Breakout and consolidation of the price below the level of 0.9238 will enable the pair to continue the decline to 0.91 – 0.90.

Analysis: Presumably, the formation of the third wave of the senior level iii continues; within this wave the one-two impetus (i) of iii of 3 has been formed, as well as the correction (ii) of iii. Given that this guess is true, we can expect that the third wave (iii) of iii of the junior level is being developed with the target level of 0.9840. The critical level for this scenario is the completion level of the second wave (ii) – 0.9238.

USD/JPY Wave analysis and forecast of 03.07 – 10.07: A chance of decline in the pair remains.

USD/JPY Wave analysis and forecast of 03.07 – 10.07: A chance of decline in the pair remains.

Estimated pivot point is at a level of 124.34.

Our opinion: Sell the pair from correction below the level of 124.34 with the target of 120.35 - 119.00. In case of breakdown of the level of 124.38 buy the pair with the target of 126.00

Alternative scenario: Breakdown and consolidation of the price above the level of 124.34 will enable the pair to continue the rise up to 126.00 – 127.00.

Analysis: Presumably, the formation of the third wave of the senior level continues on the four-hour timeframe. Locally, it is likely that the formation of the upward correction as the wave (ii) has completed. If this assumption is correct, the pair is likely to decline to 120.35. Critical level for this scenario is 124.34. Breakdown of this level will trigger the rise in the pair.

USD/СAD Wave analysis and forecast of for 03.07 – 10.07: Uptrend prevails.

USD/СAD Wave analysis and forecast of for 03.07 – 10.07: Uptrend prevails.

Estimated pivot point is at a level of 1.2419.

Our opinion: Buy the pair from correction above the level of 1.2419 with the target of 1.2830. In case of breakdown of the level of 1.2419, sell the pair with the target of 1.22 – 1.21.

Alternative scenario: Breakout and consolidation of the price below the level of 1.2419 will enable the pair to continue the decline to the levels of 1.22 – 1.21.

Analysis: Presumably, the formation of third wave of the senior level iii of 5 continues. Locally, it is likely that the “bullish” impetus is being formed as the third wave of the junior level (iii) of iii. If this assumption is correct, the pair will continue to rise to 1.28. Critical level for this scenario is 1.2419. Breakdown of this level will lead to the decline in the pair to 1.22 – 1.21.