Estimated pivot point is at the level of 1.0658.

Our opinion: Buy the pair from correction above the level of 1.0658 with the target of 1.1050 - 1.12.

Alternative scenario: Breakout of the level of 1.0658 and consolidation below this level will enable the price continue decline to 1.05.

Analysis: The third wave of the senior level is being developed on the four-hour chart frame. Locally, it is likely that the local correction as the wave (ii) has completed, and the wave (iii) of iii is being formed. If this assumption is correct and the price does not break down the critical level of 1.0658 the pair will continue to rise up to 1.1050.

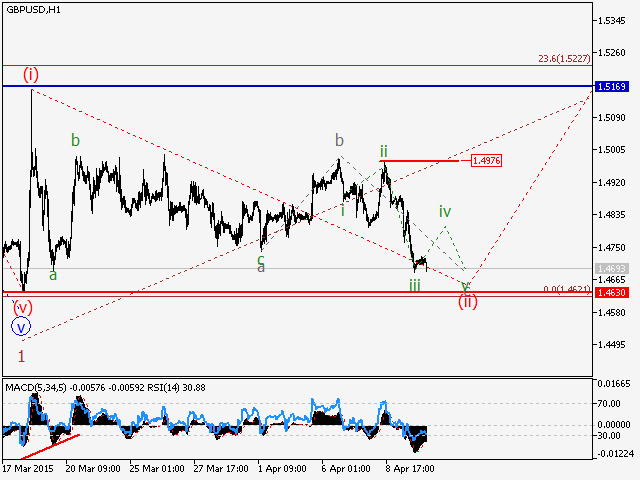

GBP/USD Wave analysis and forecast of 24.04 – 01.05: Uptrend continues.

Estimated pivot point is at the level of 1.4848.

Our opinion: Buy the pair from correction above the level of 1.4848 with the target of 1.5350.

Alternative scenario: Consolidation of the price below the level of 1.4848 will enable the price to continue decline to 1.4750 – 1.4680 as part of the correction.

Analysis: Presumably, the formation of the “bearish” impetus on the daily timeframe has completed. Locally, it is likely that the upward impetus is being formed, within which the third wave (iii) is being developed. If this assumption is correct, the pair will continue to rise up to 1.5350. Critical level for this scenario is 1.4848.

AUD/USD Wave analysis and forecast of 24.04 – 01.05: The pair is likely to grow.

Estimated pivot point is at the level of 0.7704.

Our opinion: Buy the pair above the level of 0.770 with the target of 0.7950.

Alternative scenario: Breakout and consolidation of the price below the level of 0.7704 will enable the pair to continue decline to 0.7520.

Analysis: Presumably, the formation of the downward impetus in the fifth wave of the senior level has completed. At the moment, it seems that the pair is going to reverse and the first in-lead wave in the shape of wedge is being developed. If this assumption is correct, the pair can rise up to 0.7950 within the fifth wave of the expected wedge. Critical level for this scenario is 0.7522. If this level is broken down the pair will decline to 0.74 – 0.73.

USD/JPY Wave analysis and forecast of 24.04 – 01.05: Downward correction continues.

Estimated pivot point is at the level of 120.09.

Our opinion: Sell the pair from correction below the level of 120.09 with the target of 116.80. In case of breakdown of the level of 120.09 buy with the target of 121.00.

Alternative scenario: Breakout and consolidation of the price above the level of 120.09 will enable the pair to continue the rise to 122.00.

Analysis: The formation of the “bearish” correction of the senior wave level as the fourth wave continues, within which the wave a as a zigzag (a)(b)(c) seems to develop. Locally it is likely that the wave (c) is being formed, within which the impetus can be formed. If this assumption is correct and the price does not break down the critical level of 120.09, the pair may continue to decline to 116.80.

USD/СAD Wave analysis and forecast of 24.04 – 01.05: “Bearish” correction is nearing completion.

Estimated pivot point is the level of 1.2306.

Our opinion: Sell the pair below the level of 1.2306 with the target of 1.20. If the level of 1.2306 is broken down, buy from correction with the target of 1.28.

Alternative scenario: Breakout and consolidation of the price above the level of 1.2306 will enable the pair to continue the rise up to 1.28.

Analysis: Presumably, the formation of the “bearish” correction is nearing completion in the fourth wave 4. Locally, it is likely that the impetus is being formed in the wave с of 4. If this assumption is correct, the pair will continue to decline to 1.20. Critical level for this scenario is 1.2306. Breakdown of this level will indicate the end of the correction and the beginning of the uptrend in the fifth wave.