EUR/USD Wave analysis and forecast of 29.05 – 05.06: The pair is likely to grow.

Estimated pivot point is at a level of 1.0814.

Our opinion: Buy the pair from correction above the level of 1.0814 with the target of 1.15 – 1.16. 1.1465.

Alternative scenario: Breakout of the level of 1.0814 and consolidation below this level will enable the price the decline to 1.05.

Analysis: Presumably, the formation of the bearish correction as the fourth wave, which has a shape of the zigzag, has completed. At the moment it is likely that the reversal and the first wave of the junior level are being developed. If this assumption is correct and the price does not break down the critical level of 1.0814 the pair will continue to rise up to 1.15 – 1.16 in the fifth wave.

GBP/USD Wave analysis and forecast of 29.05 – 05.06: It is expected that the pair will grow.

GBP/USD Wave analysis and forecast of 29.05 – 05.06: It is expected that the pair will grow.

Estimated pivot point is at a level of 1.5254.

Our opinion: Sell the pair above the level of 1.5388 with the target of 1.57 – 1.58.

Alternative scenario: Consolidation of the price below the level of 1.5254 will enable the pair to continue decline to 1.5190 – 1.5044.

Analysis: Presumably, the formation of the “bearish” correction in the wave B, which has a shape of the zigzag, has completed. At the moment, it is assumed that the reversal is being formed as well as the first one-two wave of the junior level. If this assumption is correct and the price will not fall below the level of 1.5254, the pair can rise up to 1.57 – 1.58.

AUD/USD Wave analysis and forecast of 29.05 – 05.06: Correction has completed; the pair is likely to grow.

AUD/USD Wave analysis and forecast of 29.05 – 05.06: Correction has completed; the pair is likely to grow.

Estimated pivot point is at a level of 0.7761.

Our opinion: Buy the pair after breakdown of the level of 0.7761 with the target of 0.7930 – 0.8160.

Alternative scenario: Breakout and consolidation of the price below the level of 0.7529 will enable the pair to continue decline to 0.74 – 0.73 in the long-term bearish trend.

Analysis: The Australian dollar continues to decline within the “bearish” correction in the supposed wave 2, which took a shape of the irregular plane with the extended wave c of 2. Locally, it is assumed that the final wave c of 2 is nearing completion and impetus is being formed within it. The price has reached estimated level of 62% - 0.7740. If this assumption is correct and the price does not break down the critical level of 0.7530, the pair can reverse and the go up.

USD/JPY Wave analysis and forecast of 29.05 – 05.06: Uptrend continues.

USD/JPY Wave analysis and forecast of 29.05 – 05.06: Uptrend continues.

Estimated pivot point is at a level of 122.50.

Our opinion: Buy the pair above the level of 122.50 with the target of 125.20.

Alternative scenario: Breakout and consolidation of the price below the level of 122.50 will enable the pair to continue decline to 120.00.

Analysis: Presumably, the formation of the bullish impetus continues in the fifth wave. Locally, it is likely that the third wave iii of 5 has completed and the local correction iv is being formed. If this assumption is correct after the completion of the wave the pair can continue to rise up to 125.20. Critical level for this scenario is 122.50. Breakdown of this level will enable the pair to continue decline to 120.00.

USD/СAD Wave analysis and forecast of for 29.05 – 05.06: Uptrend continues.

USD/СAD Wave analysis and forecast of for 29.05 – 05.06: Uptrend continues.

Estimated pivot point is at a level of 1.2357.

Our opinion: Buy the pair from correction above the level of 1.2357 with the target of 1.2655.

Alternative scenario: Breakout and consolidation of the price below the level of 1.2357 will enable the pair to continue to decline to 1.22 – 1.21.

Analysis: Presumably, the formation of the “bullish” impetus continues in the first wave within the fifth senior level. Locally, it seems that the third wave (iii) of i of 5 ahs completed and the local correction (iv) is being formed. If this assumption is correction, after its completion it makes sense to expect that the pair will continue the rise up to 1.2655. Critical level for this scenario is 1.2357. Breakdown of this level will enable the decline in the pair to 1.22 – 1.21.

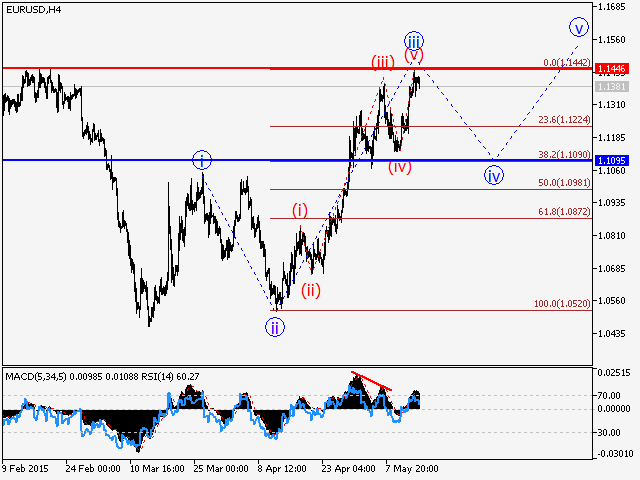

EUR/USD Wave analysis and forecast of 22.05 – 29.05: The pair is likely to decline a part of the correction.

Estimated pivot point is at a level of 1.1465.

Our opinion: Sell the pair from correction below the level of 1.1465 with the target of 1.10 – 1.09.

Alternative scenario: Breakout of the level of 1.1465 and consolidation above this level will enable the price to grow up to 1.15 – 1.16.

Analysis: The formation of the third wave iii of the senior level has completed. At the moment it seems that the correction is being formed as the fourth wave iv. Locally, the “bearish” impetus as the wave (a) of iv has completed. If this assumption is correct, the pair can grow in the wave (b) for a short time and then continue to decline to 1.0880 in the wave (c) of iv. Critical level for this scenario is 1.1465.

GBP/USD Wave analysis and forecast of 22.05 – 29.05: The pair is likely to decline as part of the correction.

GBP/USD Wave analysis and forecast of 22.05 – 29.05: The pair is likely to decline as part of the correction.

Estimated pivot point is at a level of 1.5816.

Our opinion: Sell the pair from correction below the level of 1.5816 with the target of 1.5345 – 1.52.

Alternative scenario: Consolidation of the price above the level of 1.5816 will enable the rise in price to 1.59 – 1.60.

Analysis: Presumably, the formation of the “bullish” impetus has completed in the wave A. At the moment it seems that the “bearish” correction in the wave B is being formed. Locally it is likely that the formation of the first wave of the correction a of B has completed and the wave b of B is being developed. If this assumption is correct, after its completion we can expect another downward surge up to 1.5345 – 1.52 in the wave с of B. Critical level for this scenario is 1.5816.

AUD/USD Wave analysis and forecast of 22.05 – 29.05: Uptrend continues.

AUD/USD Wave analysis and forecast of 22.05 – 29.05: Uptrend continues.

Estimated pivot point is at a level of 0.8158.

Our opinion: Sell the pair from correction below the level of 0.8158 with the target of 0.7740. If the level of 0.8158 is broken down, buy the pair with the target of 0.83 – 0.84.

Alternative scenario: Breakout and consolidation of the price above the level of 0.8158 will enable the pair to continue the rise up to 0.83 – 0.84.

Analysis: The Australian dollar is declining again. It seems that correction in the wave 2 continues taking a shape of the irregular plane. At the moment, it is likely that the wave c of 2 is being developed. Within this wave the pair can decline to 0.7740. Critical level for this scenario is 0.8158. Breakdown of this level will trigger further rise in the pair.

USD/JPY Wave analysis and forecast of 22.05 – 29.05: Uptrend has resumed. The pair is likely to decline as part of the correction.

USD/JPY Wave analysis and forecast of 22.05 – 29.05: Uptrend has resumed. The pair is likely to decline as part of the correction.

Estimated pivot point is at a level of 118.84.

Our opinion: In the short-term: sell the pair below the level of 121.26 with the target of 120.16. In the medium-term: wait for the completion of the correction and buy the pair above the level of 118.84 with the target of 122.00 – 123.00.

Alternative scenario: Breakout and consolidation of the price below the level of 118.48 will enable the pair to continue the decline to 118.00 – 117.00.

Analysis: Presumably, the formation of the correction as the fourth wave 4, which has the shape of the triangle, has completed. Locally it is likely that the one-two impetus as the wave i of 5 is being formed. If this assumption is correct after its completion the pair can continue to rise up to 122.00 – 123.00. Critical level for this scenario is 118.48. Breakdown of this level will enable the pair to decline further down to 118.00 – 117.00.

USD/СAD Wave analysis and forecast of for 22.05 – 29.05: Uptrend will resume.

USD/СAD Wave analysis and forecast of for 22.05 – 29.05: Uptrend will resume.

Estimated pivot point is at a level of 1.1918.

Our opinion: Wait for the completion of the correction and buy the pair above the level of 1918, with the target of 1.2450 – 1.28.

Alternative scenario: Breakout and consolidation of the price below the level of 1.1818 will enable the pair to continue to decline to 1.18 – 1.17.

Analysis: Presumably, the formation of the “bearish” correction in the fourth wave 4 has completed. Locally it is likely that the one-two impetus (i) has been formed and the local correction as the wave (ii) has begun. If this assumption is correct, after its completion the pair can go up to 1.2450 – 1.28. Critical level for this scenario is 1.1918. Breakdown of this level will enable the price to continue the decline to 1.18 – 1.17.

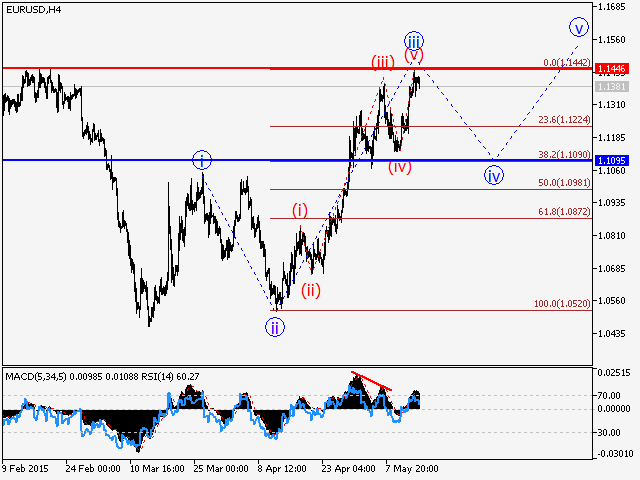

EUR/USD Wave analysis and forecast of 15.05 – 22.05: The pair is likely to decline a part of the correction.

Estimated pivot point is at a level of 1.1446.

Our opinion: In the short-term: sell the pair from correction below the level of 1.1446 with the target of 1.1090.

Alternative scenario: Breakout of the level of 1.1446 and consolidation above this level will enable the price to grow up to 1.15 – 1.16.

Analysis: The formation of the third wave iii of the senior level has completed on the four-hour timeframe; the wave has slightly extended and reached the level of 1.1446. Locally, it is likely that the decline will start in the fourth wave. If this assumption is correct and the price does not break down the critical level of 1.1446, the pair can decline to 1.1090.

GBP/USD Wave analysis and forecast of 15.05 – 22.05: The decline as part of the correction is expected.

GBP/USD Wave analysis and forecast of 15.05 – 22.05: The decline as part of the correction is expected.

Estimated pivot point is at a level of 1.5820.

Our opinion: Sell the pair from correction below the level of 1.5820 with the target of 1.55 – 1.53.

Alternative scenario: Consolidation of the price above the level of 1.5820 will enable the rise in price to 1.59 – 1.60.

Analysis: Presumably, the formation of the “bullish” impetus has completed in the first wave A of the large upward correction 2. At the moment, it seems that the reversal in the pair is being developed and if this assumption is correct, it is possible that the pair will drop to 1.55 – 1.53. Critical level for this scenario is 1.5820. Breakdown of this level and consolidation above it will cause the rise in the pair and extension of the wave v of A.

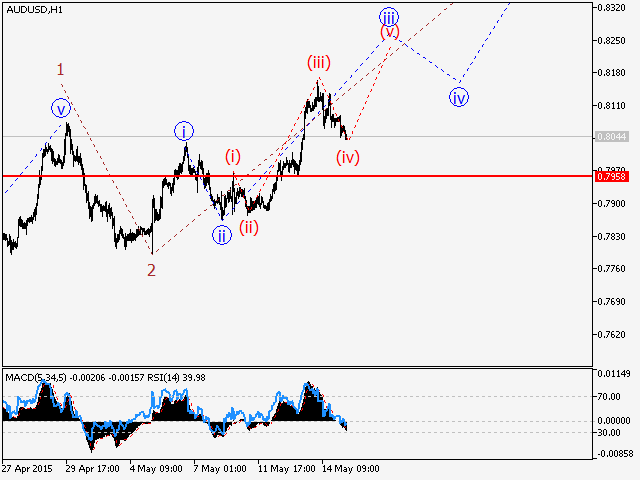

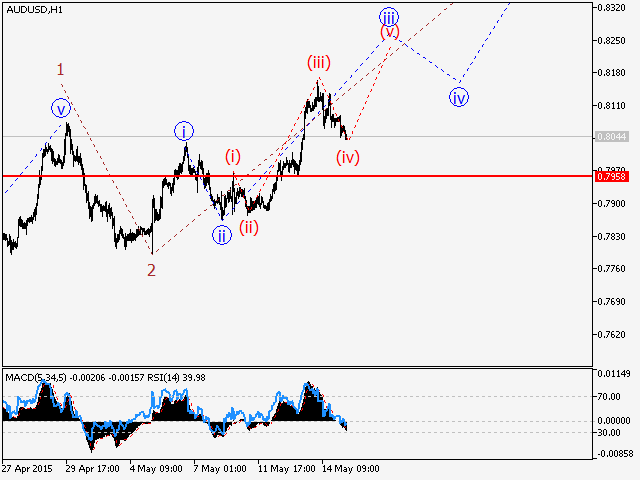

AUD/USD Wave analysis and forecast of 15.05 – 22.05: Uptrend dominates.

AUD/USD Wave analysis and forecast of 15.05 – 22.05: Uptrend dominates.

Estimated pivot point is at a level of 0.7958.

Our opinion: Buy the pair from correction above the level of 0.7958 with the target of 0.84.

Alternative scenario: Breakout and consolidation of the price below the level of 0.7958 will enable the pair to continue decline to 0.75.

Analysis: The Australian dollar continues to strengthen versus the USD. The price has reached the highs of the first wave 1, which suggests that locally, the third wave 3 is being developed. At the moment, judging by the structure of the wave growth, we can assume that the third wave of the junior level iii of 3 is being developed. If this assumption is correct, the pair can continue to rise up to 0.84. Critical level for this scenario is 0.7958. Breakdown of this level will trigger the decline in the pair.

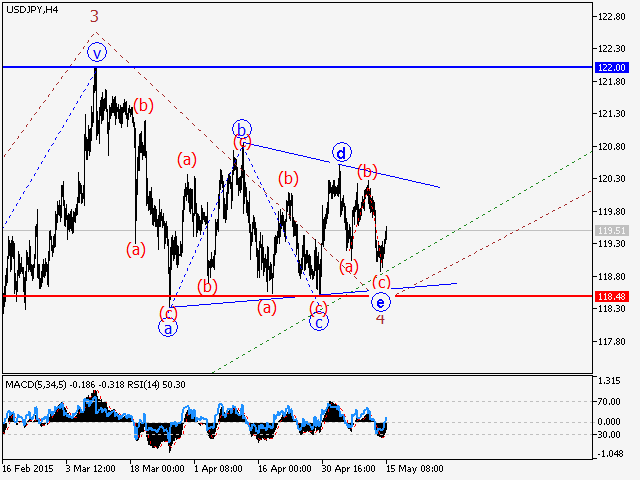

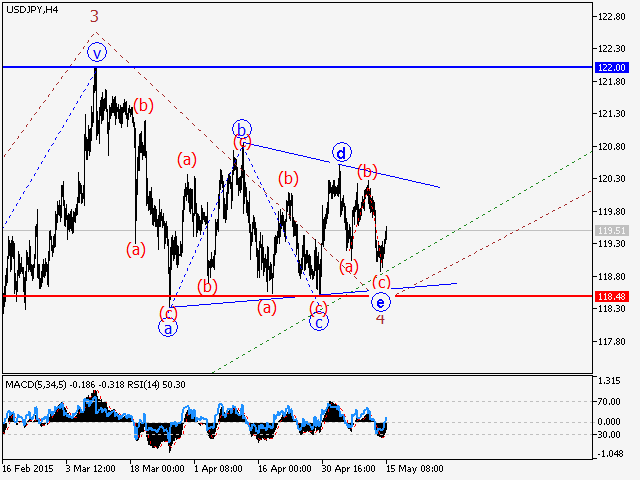

USD/JPY Wave analysis and forecast of 15.05 – 22.05: Correction has completed. The pair is likely to grow.

USD/JPY Wave analysis and forecast of 15.05 – 22.05: Correction has completed. The pair is likely to grow.

Estimated pivot point is at a level of 118.48.

Our opinion: Buy the pair from correction above the level of 118.48 with the target of 122.00.

Alternative scenario: Breakout and consolidation of the price below the level of 118.48 will enable the pair to continue decline to 118.00 – 117.00.

Analysis: Presumably, the formation of the correction as the fourth wave 4, which took the shape of the triangle, has completed. Locally it is likely that the formation of the final wave e of 4 ahs completed. If this assumption is correct the pair can rise up to the level of 122.00. in the fifth wave. Critical level for this scenario is 118.48. Breakdown of this level will enable the pair to continue decline to 118.00 – 117.00.

USD/СAD Wave analysis and forecast of for 15.05 – 22.05: The “bearish” correction is nearing completion. The pair is likely to grow.

USD/СAD Wave analysis and forecast of for 15.05 – 22.05: The “bearish” correction is nearing completion. The pair is likely to grow.

Estimated pivot point is at a level of 1.2158.

Our opinion: Buy the pair above the level of 1.2158 with the target of 1.2450 – 1.28.

Alternative scenario: Breakout and consolidation of the price above the level of 1.2158 will enable the pair to continue the rise up to 1.2450 – 1.28.

Analysis: Presumably, the formation of the “bearish” correction in the fourth wave 4 is still ongoing. Locally, it seems that the final wave c of 4 is being developed; within this wave the fifth wave of the junior level (v) of c of 4 is being formed as a wedge. If this assumption is correct, it makes sense to expect that the pair will grow up to 1.2450 – 1.28. . Critical level for this scenario is 1.2158. Breakdown of this level will enable the rise in price to 1.2450 – 1.28.

EUR/USD Wave analysis and forecast of 01.05 – 08.05: Uptrend prevails.

Estimated pivot point is at a level of 1.1042.

Our opinion: Buy the pair from correction above the level of 1.1042 with the target of 1.14 - 1.15.

Alternative scenario: Breakout of the level of 1.1042 and consolidation below this level will enable the price to continue decline to 1.08.

Analysis: The formation of the third wave of the senior level is still ongoing on the four-hour chart frame. Locally it seems that the formation of the third wave of the junior level (iii) is nearing completion. If this assumption is correct, it makes sense to expect local correction as the wave (iv) in the nearest future and, after its completion the rise in the pair to 1.14 – 1.15. Critical level for this scenario is 1.1042. Breakdown of this level will provoke the decline in the pair to 1.08 – 1.07.

GBP/USD Wave analysis and forecast of 01.05 – 08.05: Uptrend continues.

Estimated pivot point is at a level of 1.4848.

Our opinion: Buy the pair from correction above the level of 1.5167 with the target of 1.5680.

Alternative scenario: Consolidation of the price below the level of 1.5167 will enable the pair to decline to 1.4848.

Analysis: The formation of the “bullish” impetus continues in the first wave A of the large upward correction 2. At the moment, it seems that the formation of the third wave has completed and the local correction as the wave iv of A is being formed. If this assumption is correct, after the completion of the correction the pair will continue to grow up to 1.5680. Critical level for this scenario is 1.4848.

AUD/USD Wave analysis and forecast of 01.05 – 08.05: The pair is undergoing correction. The rise in the pair is possible.

Estimated pivot point is at a level of 0.7530.

Our opinion: Wait for the completion of the local correction and buy the pair above the level of 0.7737 with the target of 0.84.

Alternative scenario: Breakout and consolidation of the price below the level of 0.7737 will enable the pair to continue declining to 0.7530.

Analysis: Presumably, the formation of the first wave 1, (in which a wedge has been formed, as expected) completed. At the moment, it seems that the “bearish” correction is being formed as the wave 2, within which a zigzag can be formed. If this assumption is correct, after the completion of the local correction 2, the pair will continue to grow to the estimated level of 0.84. Critical level for this scenario is 0.7530. Breakdown of this level will trigger the decline in the pair to 0.73 – 0.71 in the long-term “bearish” trend.

USD/JPY Wave analysis and forecast of 01.05 – 08.05: A chance of decline remains.

Estimated pivot point is at a level of 120.84.

Our opinion: Sell the pair below the level of 119.25 with the target of117.70 - 116.80. If the level of 120.84 is broken down, buy the pair with the target of 122.00.

Alternative scenario: Breakout and consolidation of the price above the level of 120.84 will enable the pair to continue the rise up to 122.00.

Analysis: The formation of the zigzag continues in the fourth wave 4. Currently, it seems that the local correction in ongoing in the wave (ii), taking the shape of the plane abc. If this assumption is correct, it is likely that the correction will finish soon and the pair will continue to decline to 117.70 - 116.80. Critical level for this scenario is 120.84. Breakdown of this level trigger the rise in price to 122.0.

USD/СAD Wave analysis and forecast of for 01.05 – 08.05: “Bearish” correction has completed. The pair is likely to grow.

Estimated pivot point is at a level of 1.1940.

Our opinion: Buy the pair above the level of 1.1940 with the target of 1.23 – 1.28.

Alternative scenario: Breakout and consolidation of the price below the level of 1.1940 will enable the pair to continue declining to 1.1726.

Analysis: Presumably, the formation of the “bearish” correction in the fourth wave 4, has completed. Locally, five waves have been formed in the wave c of 4, which indicates a completion of the local “bearish” impetus. If this assumption is correct, the pair can at least rise up to 1.2840 in the fourth wave. Critical level for this scenario is 1.1940. Breakdown of this level will make possible the decline in price to 1.1726 in the fourth wave.