Estimated pivot point is at a level of 1.0520.

Our opinion: Buy the pair from correction above the level of 1.0520 with the target of 1.12 – 1.15.

Alternative scenario: Breakout and consolidation of the price below the level of 1.0520 will enable the pair to continue to decline to the levels of 1.0450 – 1.04.

Analysis: Presumably, the formation of the “bearish” impetus in the wave c of 2 has completed. Locally, it seems that the fifth wave (v), which took a shape of a wedge, has completed and one-two wave of the junior level (i) has been formed as an impetus. If this assumption is correct, after the completion of the correction (ii), it makes sense to expect that the pair will continue to grow to the levels of 1.12 – 1.14. Critical level for this scenario is 1.0520.

GBP/USD Wave analysis and forecast for : The pair is likely to rise.

Estimated pivot point is at a level of 1.4890.

Our opinion: Buy the pair from the correction above the level of 1.4890 with the target of 1.5330 – 1.54.

Alternative scenario: Breakout and consolidation of the price below the level of 1.4890 trigger the decline of the pair to the levels of 1.4800 – 1.4750.

Analysis: Presumably, the formation of the large “bearish” correction has completed in the wave B of 2, while the wave C of the senior level is developing. Locally, it is likely that one-two impetus of the junior level (i) has formed and the correction as the wave (ii) is developing at the moment. If this assumption is correct and the price does not break down the critical level of 1.4890, after the completion of the correction the pair is likely to continue the rise up to the levels of 1.5330 – 1.54.

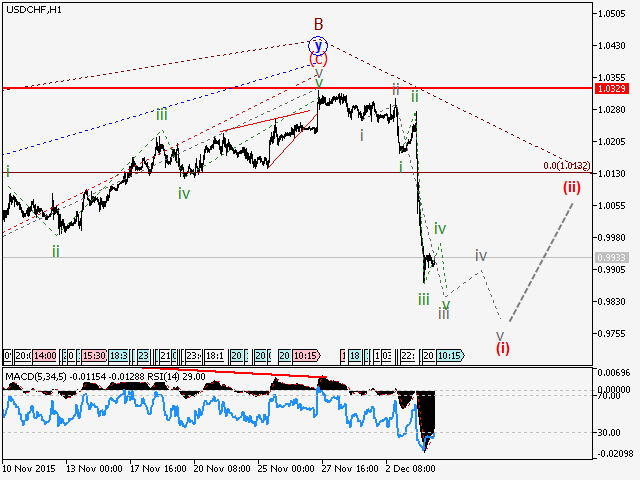

USD/CHF Wave analysis and forecast for 27.11 – 04.12: Uptrend is nearing completion. The pair is likely to decline.

Estimated pivot point is at a level of 1.0139.

Our opinion: Sell the pair below the level of 1.0139 with the target of 0.98 – 0.95.

Alternative scenario: Breakout and consolidation of the price above the level of 1.0139 will trigger the decline in the pair to the levels of 0.98 – 0.95.

Analysis: The formation of the upward impetus in the wave (c) of y of В is nearing completion. Locally, it is likely that the fifth wave of the junior level v of (c) is being developed, within which the extension is being formed that can take a shape of a wedge. If this assumption is correct, in the near future the pair can reverse and start to decline. In this situation it is risky to buy a pair, however it makes sense to sell the pair below the level of 1.0139. Breakdown of this level will confirm that the reversal has formed and, therefore, the pair can decline.

USD/JPY Wave analysis and forecast for : The pair is likely to decline.

Estimated pivot point is at a level of 123.65.

Our opinion: Sell the pair from correction below the level of 123.65 with the target of 122.00 – 121.00. In case of breakdown of the level of 123.65, buy the pair with the target of 124.50.

Alternative scenario: Breakout and consolidation of the price above the level of 123.65 will enable the pair to continue the rise up to 124.50.

Analysis: Presumably, the formation of the upward correction in the wave c of B of 4 has completed. At the moment, it seems that the wave C of the senior level is developing, in which one-two impetus is being formed (i). If this assumption is correct and the price does not break down the critical level of 123.65, the pair will continue to decline to the level of 121.00.

USD/СAD Wave analysis and forecast for : The pair is likely to decline.

Estimated pivot point is at a level of 1.3407.

Our opinion: Sell the pair from correction below the level of 1.3407 with the target of 1.30 - 1.28.

Alternative scenario: Breakout and consolidation of the price above the level of 1.3407 will enable the pair to continue the rise up to the levels of 1.3480 - 1.35.

Analysis: Presumably, the formation of the double zigzag wxy has completed in the wave B of 4. Locally, it is likely that one-two wave (i) of the junior level has developed, as well as the correction to it (ii). If this assumption is correct and the price does not break down the critical level of 1.3407, the pair can decline to the levels of 1.30 - 1.28 in the wave С of 4.

No comments:

Post a Comment