The euro is almost unchanged on Tuesday, as EUR/USD continues to have a quiet week. In the European session, EUR/USD is trading in the low-1.13 range. On the release front, French Industrial Production was unexpectedly high, with a strong gain of 1.5%. In the US, today’s highlight is JOLTS Job Openings.

Greece may be one of the smaller members of the Eurozone, but it continues to command the attention of world markets, as the bailout crisis continues. After the new Greek government said it would not renew the EUR 240 billion bailout under the current terms, the ECB announcement that it will no longer accept Greek government bonds as collateral for ECB loans as of February 11. Greece wants a new deal that removes the harsh austerity steps required under the bailout. However, Germany and Greece’s international creditors do not want to rewrite the bailout agreement. Greek Prime Minister Alexis Tsipras and Angel Gurria, chairman of the OECD, will meet on Tuesday to try and narrow the gap between the parties. On Wednesday, EU finance ministers meet in Brussels, with the Greek crisis on top of the agenda.

US releases ended the week with a superb US Nonfarm Payrolls report for January. The key employment indicator improved to 257 thousand in January, up from 252 thousand a month earlier. This easily beat the estimate of 236 thousand. The Federal Reserve has been clear that the employment numbers will have to be strong before a rate hike kicks in, so the strong NFP reading has reinforced expectations for an interest rate in mid-2015, which would be a boost for the US dollar. We’ll get a look at additional US employment data on Tuesday, with the release of JOLTS Job Openings. The markets are expecting the indicator’s recent upward trend to continue, with an estimate of 5.05 million.

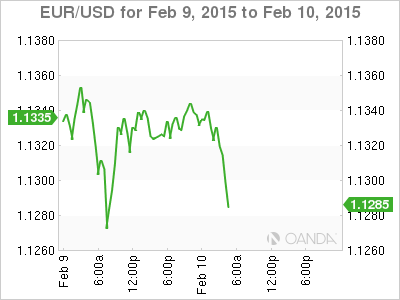

EUR/USD for Tuesday, February 10, 2015

EUR/USD Daily Chart

EUR/USD February 10 at 9:05 GMT

EUR/USD 1.1309 H: 1.1345 L: 1.1306

EUR/USD Technical

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.1066 | 1.1154 | 1.1231 | 1.1340 | 1.1426 | 1.1525 |

- EUR/USD was flat in the Asian session. The pair has edged lower in European trade.

- On the upside, 1.1340 remains under pressure. Will this line break during the day? 1.1426 is stronger.

- 1.1231 is an immediate support line.

- Current range: 1.1231 to 1.1340

Further levels in both directions:

- Below: 1.1231, 1.1154, 1.1066 and 1.0909

- Above: 1.1340, 1.1426, 1.1525, 1.1634 and 1.1754

OANDA’s Open Positions Ratio

EUR/USD ratio is pointing to gains in short positions on Tuesday, reversing the direction we saw a day earlier. This is consistent with the movement of the pair, as the euro has posted small losses. The ratio has a majority of short positions, indicative of trader bias towards the euro moving lower.

EUR/USD Fundamentals

- 7:45 French Industrial Production. Estimate 0.3%. Actual 1.5%.

- 9:00 Italian Industrial Production. Estimate 0.1%.

- 13:20 US FOMC Member Jeffrey Lacker Speaks.

- 14:00 US NFIB Small Business Index. Estimate 101.3 points.

- 15:00 US JOLTS Openings. Estimate 5.03M.

- 15:00 US IBD/TIPP Economic Optimism. Estimate 51.4 points.

- 15:00 US Wholesale Inventories. Estimate 0.2%.

No comments:

Post a Comment