Estimated pivot point is at a level of 1.0804.

Our opinion: Wait for completion of correction and buy the pair above a level of 1.0804 with a target at about 1.1850 – 1.20.

Alternative scenario: Breakout of the level 1.0804 and consolidation below will allow the pair to continue declining to levels 1.06 – 1.05.

Analysis: Supposedly, the third wave of senior level 3 continues to form. Apparently, the first counter-trend wave of junior wave level i of 3 shaped like a diagonal with the extended fifth wave stopped forming locally. A correction in a form of the wave ii of 3 that reached the level of 50% at 1.1260 started to form. If the presumption is correct, after correction, the pair will continue to grow to the levels 1.1850 – 1.20. The level of 1.0804 is critical in this scenario as the breakout will enable the pair to continue declining to the levels 1.06 - 1.05.

GBP/USD Wave analysis and forecast of 28.08 – 04.09: The pair is expected to decline.

Estimated pivot point is at a level of 1.5819.

Our opinion: Wait for completion of an ascending correction (ii) of C and sell the pair below the level of 1.5819 with a target at about 1.52. Buy the pair with a target of 1.60 – 1.62 in case the level 1.5819 is broken.

Alternative scenario: Breakout and consolidation above the level of 1.5819 will allow the pair to continue the rise up to the levels of 1.60 – 1.62.

Analysis: Supposedly, a correction of senior level continues to form within the wave X, currently shaped like a plane. Apparently, an impetus within the first wave (i) of c has stopped forming, and a short-term growth to a level of 1.56 is expected. If the presumption is correct, after correction, the pair will continue to decline to the level at 1.52. The level of 1.5819, a top of the wave b of X, is critical in this scenario.

USD/CHF Wave analysis and forecast for 28.08 – 04.09: The pair is expected to decline.

Estimated pivot point is at a level of 0.9792.

Our opinion: Sell the pair from corrections below the level of 0.9792 with a target at . Buy the pair with a target of 1.0 – 1.10 in case the level at 0.9792 is broken.

Alternative scenario: Breakout and consolidation above the level of 0.9792 will allow the pair to continue the rise up to the levels of 1.0 – 1.10.

Analysis: Supposedly, a big bearish correction in a form of the wave 2, within which a plane is expected to form, continues to develop. Apparently, the wave с of 2 is forming locally, with the first wave (i) forming within. If the presumption is correct, the pair will continue to decline to the levels . The local maximum level at 0.9792 is critical in this scenario.

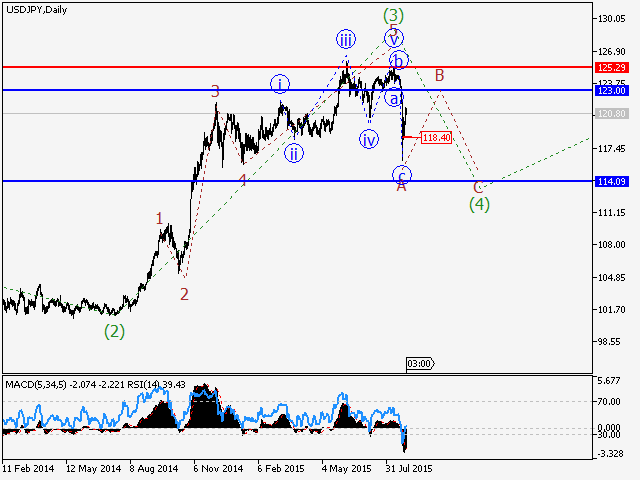

USD/JPY Wave analysis and forecast of 28.08 – 04.09: Bearish correction continues to form.

Estimated pivot point is at a level of 125.30.

Our opinion: Wait for completion of correction and sell the pair below a level of 125.30 with a target at about 115.00 – 114.00.

Alternative scenario: Breakout and consolidation above the level of 125.30 will allow the pair to continue the rise up to the levels of 127.00 – 128.00.

Analysis: Apparently, a big bearish correction in a form of fourth wave (4) continues to develop. Apparently, the first zigzag-shaped wave А of (4) has formed locally, and the wave B is forming now. If the assumption is correct, another wave of decline can be logically expected after correction, to about 115.00 – 114.00. The level of 125.30 is critical in this scenario.

USD/СAD Wave analysis and forecast of for 28.08 – 04.09: Uptrend continues.

Estimated pivot point is at a level of 1.3012.

Our opinion: Buy the pair from corrections above the level of 1.3012 with a target of 1.35 – 1.36.

Alternative scenario: Breakout and consolidation below the level of 1.3012 will allow the pair to continue declining to a level of 1.2660.

Analysis: Supposedly, the formation of an ascending impetus within the third wave of senior level (3) is nearing completion. Apparently, the fifth wave of junior level v of 5 of (3) is forming locally. If the presumption is correct, the pair will logically continue to rise to a level of 1.35. The level of 1.3012 is critical in this scenario as the breakout will make the pair decline to about 1.2660.Supposedly, the formation of an ascending impetus within the third wave of senior level (3) is nearing completion. Apparently, the fifth wave of junior level v of 5 of (3) is forming locally. If the presumption is correct, the pair will logically continue to rise to a level of 1.35. The level of 1.3012 is critical in this scenario as the breakout will make the pair decline to about 1.2660.

No comments:

Post a Comment