Estimated pivot point is at a level of 1.1500.

Our opinion: Sell the pair from correction below the level of 1.1500 with the target of 1.1050. In case of breakdown of the level of 1.1500, buy the pair with the target of 1.17.

Alternative scenario: Breakout and consolidation of the price above the level of 1.1500 will enable the pair to continue to rise up to1.17.

Analysis: Presumably, the formation of the correction as the second wave 2 of the senior level continues. Locally, it is likely that the formation of the wave b of 2 has completed and downtrend in the wave c of 2 is being developed. If this assumption is correct and the price does not break down the critical level of 1.15, the pair will continue to decline to the level of 1.1050 – 1.10.

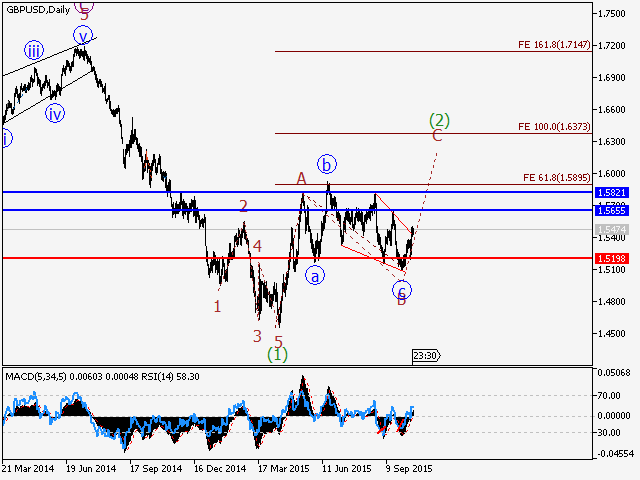

GBP/USD Wave analysis and forecast for 16.10 – 23.10: Uptrend continues.

Estimated pivot point is at a level of 1.5200.

Our opinion: Buy the pair from correction above the level 1.5200 with the target of 1.57 – 1.58.

Alternative scenario: Breakout and consolidation of the price below the level of 1.5200 will enable the pair to continue to decline to 1.51.

Analysis: Presumably, the formation of the correction of the senior level has completed in the wave В of (2), which took a shape of the irregular plane with the diagonal triangle (KDT) in the wave c of B. Locally, it is likely that the one two wave (i) is being developed, which has taken a shape of the extending diagonal triangle. If this assumption is correct, after the completion of the local correction the pair will continue to rise to the level of 1.60 – 1.63 in the wave С of (2). Critical level for this scenario is 1.51.

USD/CHF Wave analysis and forecast for 16.10 – 23.10: The decline in the pair is likely to continue.

Estimated pivot point is at a level of 0.9840.

Our opinion: Sell the pair below the level of 0.9840 with the target of 0.9245. In case of breakdown of the level of 0.9840, buy with the target of 1.0130.

Alternative scenario: Breakout and consolidation of the price above the level of 0.9840 will enable the pair to rise up to 1.0 – 1.0130.

Analysis: Presumably, the formation of the wave C continues in the second 2 wave of the senior level. Locally, it seems that the correction as the second wave (ii) of the junior level has completed and the wave (iii) is being developed. If this assumption is correct and the price does not break down the critical level of 0.9840, the pair will continue to decline to the level of 0.9245.

USD/JPY Wave analysis and forecast for 16.10 – 23.10: The decline in the pair will continue.

Estimated pivot point is at a level of 120.35.

Our opinion: Sell the pair from correction below the level of 120.35 with the target of 115.00 – 114.00. In case of breakdown of the level of 120.35, buy with the target of 122.00.

Alternative scenario: Breakout and consolidation of the price above the level of 120.35 will make possible the rise in the pair up to the levels of 122.00 – 124.00.

Analysis: Presumably, the formation of the triangle within the wave b of A of (4) of the estimated zigzag has completed. Locally it is likely that the wave с of А is being developed, within which the third wave (iii) is being formed. If this assumption is correct and the price does not break down the critical level of 120.35 the pair can continue to decline to the level of 115.00.

USD/СAD Wave analysis and forecast for 16.10 – 23.10: The decline as part of the correction is likely to continue.

Estimated pivot point is at a level of 1.3074.

Our opinion: Sell the pair from correction below the level of 1.3074 with the target of 1.2485. In case of breakdown of the level of 1.3074 buy the pair with the target of 1.3220 – 1.3320.

Alternative scenario: Breakout and consolidation of the price above the level of 1.3074 will enable the pair to continue to rise to the level of 1.3220 – 1.3320.

Analysis: Presumably, the formation of the upward impetus in the third wave of the senior level (3) has completed. At the moment, it seems that the large “bearish” correction is being developed as the fourth wave (4). Locally, it is assumed that the zigzag is being formed in the wave А of (4). If this assumption is correct, the pair will continue to decline to the level of 1.2485. Critical level for this scenario is 1.3450. Breakdown of this level will trigger the rise in the pair to the levels of 1.36 – 1.37.

No comments:

Post a Comment